December 22, 2023

By: Isabell Bücher

Future trends for process manufacturing in 2024

2023 brought a number of challenges for process manufacturing, including ongoing geopolitical tensions. Global markets remain uncertain, the labor market is still tight, and supply chain issues are still dogging global manufacturing networks, all of which are expected to continue to pose difficulties for manufacturers in 2024.

However, 2023 also saw the manufacturing industry continue to build on its post-pandemic momentum. Massive US public investments in manufacturing through the Infrastructure Investment and Jobs Act (IIJA), the Creating Helpful Incentives to Produce Semiconductors (CHIPS) and Science Act, and the Inflation Reduction Act (IRA) pushed the industry along, while also driving increased private investment. Manufacturing benefited globally as other countries felt the pressure to keep up.

Data about the industry’s outlook for next year is mixed. On the one hand, annual construction spending in manufacturing reached $201 billion by July 2023, a 70% YOY increase which sets the stage for further growth in 2024. Set against that is Deloitte’s analysis of Purchasing Managers’ Index (PMI) data, which reveals that the sector was still contracting for most of 2023 and paints a more gloomy picture for the future.

With so much stimulus and challenge, it’s impossible to say what 2024 will bring to the sector as a whole. However, there are a number of trends that we see as helping shape the next 12 months for process manufacturers.

Manufacturing organizations will continue to strengthen the supply chain

Supply chain has been a primary concern for manufacturing companies for several years now, and it seems likely to continue into 2024. Although the crisis of COVID-19 has eased, with Deloitte reporting that average delivery times for production materials have fallen from a peak of 100 days in July 2022 to 87 days in August 2023, matters haven’t returned to pre-pandemic norms.

The National Association of Manufacturing (NAM)’s Manufacturing Leadership Council (MLC) warns that supply chain disruption could continue for at least another year. Fears about geopolitical disruptions to trade routes have many manufacturers working to refigure their supply chains to be more resilient through ally-shoring, near-shoring, and reshoring.

Companies are also seeking to lower operational costs and shorten lead times through successful relocation. BCG adds that such a move can reduce manufacturing and supply-chain costs by up to 50% and build a competitive advantage, as well as improving resilience and sustainability. Manufacturers who haven’t yet fully integrated their supply chains will prioritize this goal, with the number rising from 19% in 2023 to 47% by 2025.

The need to stabilize the supply chain is translating not just into relocation, but also digitalization. A Deloitte study found that over three-quarters of manufacturers are adopting digital tools to increase supply chain transparency, and separate Deloitte research reported that 21% are already integrating metaverse technologies such as digital twins and blockchain for this purpose. Expect these trends to continue through 2024, as companies pursue resilience and lower vulnerability to the next global crisis.

Predictive analytics and AI will continue to deliver value

Many manufacturing organizations are still in relatively early stages of adoption for artificial intelligence (AI) applications, with 57% telling an MLC study that they are still piloting or experimenting with AI. However, 96% intend to use AI in the future, so we predict that 2024 will see manufacturing companies continue to adopt AI solutions. Microsoft sees AI as the key mega-trend that’s reshaping the future of manufacturing, driving connected workforces, smart factories, the industrial metaverse, agile supply chains, and greater sustainability.

Predictive analytics will remain a dominant application for AI, with the market forecast to expand at a CAGR of 22.24% to reach $2,1601.17 million by 2027. This is largely driven by the rising cost of unplanned downtime, which now costs at least 50% more per hour than it did two years ago across every industry, thanks to inflation and supply chain challenges. In Oil & Gas, for example, an hour’s downtime causes losses of almost $500,000. It’s no surprise that predictive maintenance and predictive monitoring solutions that can help cut these losses are going to see an ongoing surge in adoption.

Automation is another key AI trend. Manufacturers that automated any part of production enjoyed 30% higher growth in 2022 than those continuing to rely on manual processes. Cobots, autonomous robots, and robotic process automation (RPA) can all be expected to see sustained adoption throughout 2024 and beyond.

But generative AI will proceed more slowly

While other industries rush to adopt generative AI, manufacturing has moved more slowly and will continue to do so. Manufacturing involves complex interactions and expensive equipment, so the fallout from any mistakes due to untested technologies could be extremely high. Manufacturing organizations also can’t afford the security risks of public genAI systems. In Forrester’s July 2023 Smart Manufacturing Predictions Report, 29% of survey respondents said their use of genAI is still experimental.

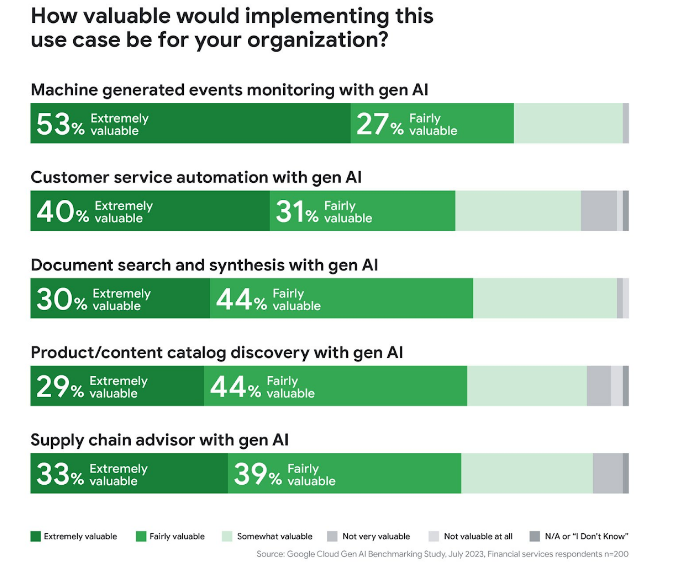

In due course, generative AI could bring considerable benefits to areas like product design and supply chain management, as well as in marketing, demand forecasting, and customer support. Google research found that 82% of manufacturing organizations that are considering or already using gen AI agree that it will bring significant or transformative change to the industry. Top use cases include events monitoring, customer service automation, and document search and synthesis. We predict that genAI will prove significant in manufacturing, but not in 2024.

The industrial metaverse will expand rapidly

Thanks to advances in a range of technology adoption, the majority of factories already have the foundations for the industrial metaverse in place, including digital twins, cloud computing, IIoT, smart contracts, and blockchain. As a result, the industrial metaverse could explode into regular use next year.

Almost all the industry executives it surveyed recently by Deloitte said their company is experimenting with or implementing at least one metaverse-related use case, and most are running more than six. Close to 40% intend to substantially grow their use of metaverse technologies over the next three years, with almost two-thirds agreeing that these technologies will fundamentally transform how manufacturers do business over the next five years.

Forrester likewise predicts that the coming year will see manufacturing lead the way out of the “metaverse winter” of 2023, as organizations focus on use cases that drive the most value. With the industrial metaverse, manufacturers can test and refine designs in an immersive environment, track goods in real time, and connect digital twins throughout the entire organization, including processes, assets, products, supply chain, and partner assets. With so much value waiting to be unlocked, we’d be more surprised if the industrial metaverse doesn’t take off in 2024.

IIoT will move towards real time data

The Industrial Internet of Things (IIoT) is still a top trend, and research by Polaris predicts that the market will grow at a CAGR of 23.5% between 2022 and 2032, to reach a total value of $2,580.89 billion.

According to Ubisense, the next frontier for IIoT is real time reporting, with adoption standing at around 43%, in contrast to 62% for IIoT technology in general. Real time visibility will close gaps in the quest for operational excellence, improve process optimization, and enable faster responses to fluctuating production demands.

Labor force pressures will still drive changes

A recent survey by the NAM reported that attracting and retaining a quality workforce is the biggest business challenge for close to three-quarters of manufacturing organizations. Lack of talent is still causing significant damage to the industry, with 45% saying that it forced them to refuse business opportunities, and 71% reporting that it affected their timelines for product deliveries.

As a result, manufacturers will continue to implement strategies to ease pressure in their workforce. Tactics include increasing wages, offering greater flexibility around scheduling, and investing in a talent pipeline to nurture a new generation of skilled workers. The labor shortage is also helping drive adoption of AI and predictive monitoring solutions, as plants seek ways to maximize productivity with a smaller workforce.

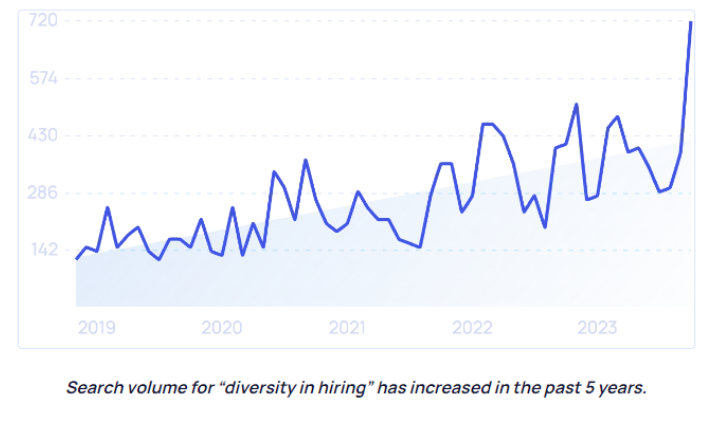

We’ll also see ongoing initiatives around reskilling, both to improve the in-house talent pool and increase employee retention. Younger workers, in particular, say that training and development opportunities are a key reason why they choose to stay with their employer. Alongside this, manufacturers are increasing their focus on diversity and inclusion, with 63% reporting that it improves their ability to attract and retain talent.

The benefits of smart factories will continue to be felt

A number of trends including AI, predictive analytics, automation, and digital twins come together to drive the ongoing embrace of smart manufacturing. Faced with an amalgamation of stresses, including a disrupted supply chain, tight labor market, global economic uncertainty, and rising costs, manufacturing companies will continue to deploy smart factory initiatives that bolster their operational resilience and agility.

Deloitte’s research found that 86% of manufacturing executives expect smart factory solutions to be the primary driver for competitiveness over the next 5 years, and IDC data reveals that 72% of manufacturing organizations have moved beyond proof-of-concept. Reflecting this expectation, the global smart manufacturing market is predicted to reach $241 billion by 2028, at a CAGR of 17.2%. We can expect smart factories and smart manufacturing use cases to continue to see strong adoption in 2024.

Sustainability is an ongoing concern

Manufacturing organizations are still highly aware of pressure from consumers and partners to advance their sustainability efforts. Many companies are struggling to implement electrification and decarbonization in their processes, but attempts to integrate green fuels, circular manufacturing, and reusable and recyclable packaging are continuing apace.

We can expect to see a range of strategies employed over the next 12 months to help reduce manufacturing’s environmental impact. Some companies are turning to external partnerships to meet their emissions goals, others are investing in alternative clean energies, while some are looking to invest in creative sustainability tactics.

Rising data volumes are driving their own trends

With the rise in IIoT and connected devices, growth in AI analytics, and value of predictive monitoring and predictive maintenance solutions, the amount of data that manufacturing plants are producing is increasing exponentially. This is causing manufacturers to adopt other technologies and tools that maximize the benefits they can gain from data.

These include 5G networks, which allow the transmission of data to analytics tools far more quickly and efficiently. Cloud computing is also seeing increasing adoption, as it permits the application of SaaS and IaaS solutions that leverage data for greater impact. Cloud adoption grew from 58% in 2022 to 70% in 2023, and businesses that migrated to the cloud are reporting higher revenue and profit growth, which will encourage others to follow suit.

At the same time, the rising volume and value of data is adding to cybersecurity concerns. Sophos’ State of Ransomware in Manufacturing and Production report finds that over 50% of manufacturing organizations were subject to ransomware attacks, while IBM reports that manufacturing was the most-targeted sector for ransomware attacks in 2022. With vital manufacturing infrastructure an increasing target for malicious actors, cybersecurity solutions and protocols will be a high priority in 2024.

Manufacturing ecosystems are growing more flexible

In the wake of global market uncertainties and the need for increased resilience and agility, many manufacturers are exploring creative ways to make their organizations more responsive and robust. Growing demands for personalization, customization, and small runs are adding to the impetus for manufacturers to embrace agile and resilient manufacturing.

One trend that’s gaining traction is that of local micro-factories, which use hyper-autonomous manufacturing to produce and/or assemble complex products and systems. They are easy to deploy and well suited to smaller, customized product runs.

Alongside micro-factories comes the rise of additive manufacturing, also known as 3D printing. Additive manufacturing enables manufacturers to produce specialized parts and equipment or customized components within a very short timeframe. This helps cut downtime, speed up repairs, and support more personalized and agile manufacturing. The metal 3D printing market alone is predicted to grow at a CAGR of 19.5% to reach $11.6 billion by 2028.

In 2024, uncertainty is the biggest hazard

As we move into 2024, the only thing that is certain is that manufacturers need to prepare to deal with uncertainty. Strong ongoing adoption of technologies that boost resilience and agility, including AI, predictive monitoring, the industrial metaverse, supply chain digitization, IIoT, smart factories, and more is part of the preparations that manufacturing organizations are making to deal with the unpredictable future. By taking steps to bolster the supply chain, improve labor acquisition and retention, increase sustainability, and raise their ability to adapt to changing circumstances, manufacturers can set the stage for continued success in 2024, no matter what comes their way.